Why companies are shifting part of their fleet to short-term rentals

Companies in Slovakia and Europe are changing their approach to company cars. Instead of "buy and hold", they are increasingly opting for a mix of a stable fleet and a flexible reserve - i.e. cars that can be added or returned as needed. This article will explain what's happening in the market, what exactly short-term leasing means, when it makes sense for SMEs and HR, and how to set up your fleet so you're not paying for unused cars.

What does "short-term leasing" mean in practice

In Slovak, the term "short-term leasing " often covers several models. Most often it is:

1) Short-term lease (days to weeks)

- Typically for road trips, season, replacement vehicle during servicing

- price is more "daily", flexibility is highest

2) Monthly rental / "car for a month" (1-3+ months)

- Solution for projects, onboarding, bridge delivery

- often with mileage packages and simple monthly invoice

- An example is AVIS Business month with the ability to customize the length of the lease and with mileage packages (e.g. 3,000 or 5,000 km/month) [1]

3) Flexible operating lease (typically 3-12 months)

- Contractually "cleaner" than a typical short-term lease, but still flexible

- suitable when you want cost predictability and service "in one instalment"

- AVIS MaxiRent communicates flexible operating leases e.g. 3-12 months [3]

4) Classic operating lease (often 36-72 months)

- stable fleet, longer horizon, usually lowest monthly cost for the same class

- AVIS Lease describes an operating lease as a long-term lease with service within an agreed scope [2]

A practical definition for this article:

Short term lease = a car that you can deploy and remove within a horizon of weeks to months without "hanging" in CAPEX and tying up the capacity of your internal teams.

Why companies are moving to flexibility now

There are more reasons, but several trends have come together in 2024-2026:

- Uncertainty in demand and projects: firms have more short contracts, seasonal peaks and temporary reinforcements (typically logistics, service, events, construction).

- Cost and cash-flow pressures: pay-as-you-use is favoured instead of large one-off expenses.

- Regulation and ESG: the EU is pushing to decarbonise corporate fleets; corporate purchases account for around 60% of car registrations in the EU [4]. This increases pressure for planning and testing of alternative propulsion.

- Residual value risk (especially for EVs): price volatility in the secondary market changes calculations; the impact of residual values on lease payments and renewal strategy has been repeatedly addressed in Europe [9].

- Fleet ageing: on average, older cars imply a higher risk of breakdowns and servicing costs; in the EU, the average age of passenger cars is around 12+ years [6].

The 7 most common reasons why a company keeps a "flex" fleet

1) Fluctuating mobility needs (projects, season, new orders)

SME companies often don't want to buy a car "just in case". If you have:

- Seasonal peaks (e.g. November-December in e-commerce),

- new contracts for 2-4 months,

- outbound teams,

... short-term leasing acts as a safety valve. You pay as you go.

Tip: set a rule: "Flex cars only for needs up to 6 months". If the need stabilizes, move the vehicle to a longer solution.

2) HR onboarding: car as a benefit without waiting

When onboarding a new colleague, time tends to be the most precious. The car often:

- Speed up productivity (sales, service, management),

- simplify commuting and retention,

- reduce relocation stress.

The "car-for-a-month" model is practical when you don't have a final car-policy yet or are waiting for a long-term option to be approved.

HR tip: implement a "probation car" - a temporary vehicle for 1-3 months that will either return after the probationary period or be replaced with a longer-term solution.

3) Bridging delivery times or vehicle downtime

If you're waiting for a new car to be delivered (or it's sitting in the shop), short-term leasing is the cleanest alternative to improvisation.

Tip: always calculate the cost of non-use (lost sales, missed appointments, missed mileage). It is often higher than the difference between the monthly rental and the long-term payment.

4) Cash-flow and investment view: CAPEX vs. OPEX in practice

Short-term leasing shifts mobility to regular freight, which helps:

- Budget planning,

- scaling up and down,

- not employing capital in assets that cost half the time.

Mini-example (illustrative):

- You have 12 people in the field, but realistically you need 9 cars steady and 3 only at peak times,

- with a 9 "core" + 3 "flex" model, you reduce the risk of three cars standing idle.

Always adjust the numbers according to your reality (especially mileage, seasonality and type of work). This approach is about managing variability, not "lowest cost on paper".

5) Risk transfer: service, premiums, damages, residual value

When you own your own fleet, you bear:

- Unscheduled repairs,

- premium fluctuations,

- administration (tyre service, TK/EK, spare vehicles),

- sales and residual value risk.

With a rental/operating lease, much of the risk is transferred to the lessor (subject to the terms of the contract, of course). At a time when the market is changing rapidly, this is a strategic advantage for many companies.

6) ESG and an EV "pilot" without a big commitment

As the EU aims to accelerate the decarbonisation of corporate fleets and prepares measures to take into account the situation of SMEs [4], many companies are following the path:

- 1-2 EVs to pilot,

- TCO evaluation in real conditions,

- then make a bigger decision.

Tip: when piloting, look at 4 things: (1) charging availability, (2) residual value, (3) actual range in winter, (4) driver satisfaction.

7) Easier administration for SME and HR

SMEs make up the vast majority of businesses in the country and employ the majority of people in the non-financial sector [7]. In practice, this means that:

- They often do not have a separate fleet team,

- the fleet is handled by HR, office manager or CFO "on the side of everything".

Therefore, the model that wins is:

- Quick to deploy,

- predictable for billing,

- easy to change.

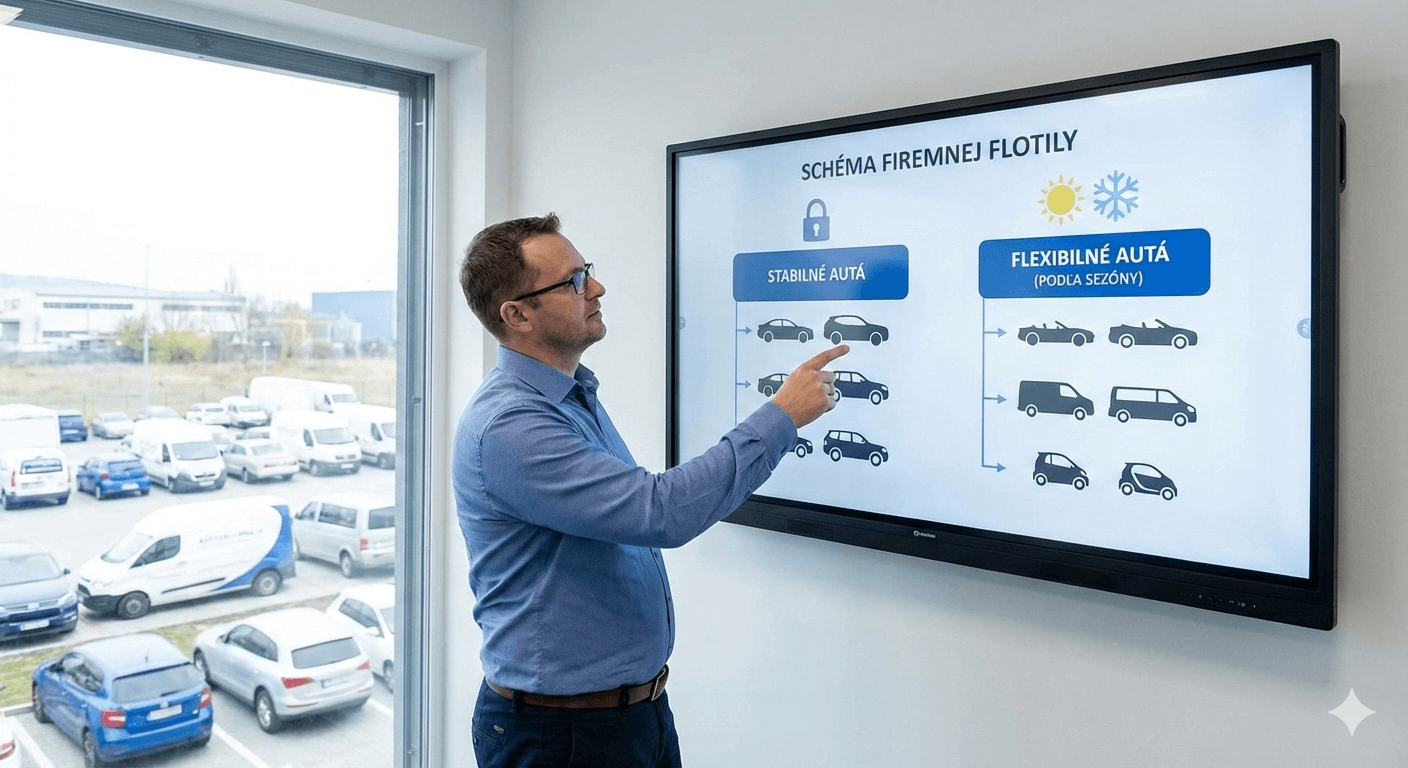

How to set the optimal "core + flex" fleet mix

Step 1: Divide the needs into 3 buckets

- Core (permanent): daily use, stable role (sales, service, management)

- Flex (variable): season, projects, onboarding, waiting periods

- Ad-hoc (impact): weekend, event, spare vehicle for a few days

Step 2: Set simple decision rules

- If the need lasts up to 3 months → monthly rental / short-term model

- if the need lasts 3-12 months → flexible operating lease

- if the need lasts 12+ months stable → long-term solution (operating lease / own fleet according to policy)

Step 3: Follow 5 KPIs that decide more than price

- Utilization (days/month and km/month)

- Cost of availability (how much does a "car ready" cost)

- downtime (service, accidents, inoperability)

- internal time (how many hours per month the team spends managing the fleet)

- driver satisfaction (HR metric, often determines retention)

When short-term leasing is not worthwhile

Short-term solutions can be more expensive if:

- You have a steady high mileage and the car is driven every day,

- you need special rebuilds or paint jobs that you want to keep for years,

- you have strict internal rules (e.g. uniform equipment, telematics, safety standards),

- you can achieve excellent TCO on your own fleet due to high volume.

Solution: make a "switch point" - a threshold from which it is worth switching from flex to long term (e.g. after the 5th month of stable need).

How AVIS solves it: rapid deployment and longer-term models

AVIS in Slovakia combines multiple services so that you can switch according to the situation:

AVIS Business month (monthly rental without commitment)

- communicated flexibility: extend, shorten, swap according to business development [1]

- Mileage packages (e.g. 3,000 / 5,000 km per month) [1]

- fast availability of vehicles at the branch (in communication also "from 0 to 30 min") [1]

AVIS Van Rental (commercial vehicles and vans)

- suitable for logistics, servicing, moving, seasonal and peak periods

- advantageous for bridging the delivery of your own van or for a temporary project [1]

AVIS MaxiRent (flexible months horizon)

- Longer term rental / flexible operating lease, suitable for projects and temporary crews [3]

AVIS Lease (operating lease)

- for the stable part of the fleet, when you want a longer horizon and a service package within an agreed range [2]

Practical checklist for SME and HR

Before choosing a solution, answer:

- How long do I realistically need the vehicle for (2 weeks / 3 months / 2 years)?

- What will be the mileage (km/month) and type of trips (city vs. highway)?

- Is this a "core" role or just a temporary bridge?

- Who will be the driver (new colleague, freelancer, sharing between teams)?

- Do I need a van, 7-9 seats, or a passenger car?

- What are my internal rules (insurance, deductibles, driver authorizations)?

Quick recommendation:

- If you're handling onboarding and projects, have a "flex framework" ready - so HR doesn't have to invent a process from scratch every time.

Frequently Asked Questions (FAQ)

1) Short-term leasing vs. operating leasing - what is the difference?

Short-term leasing is primarily about flexibility (weeks to months). Operating leases are typically a longer commitment (years) with a lower monthly cost with a stable need.

2) Can I extend or shorten my lease?

With monthly and flexible products, this tends to be the main advantage - in practice, the length is adapted according to the situation (according to the terms of the specific offer) [1].

3) What about billing and charging (OPEX/CAPEX)?

Most companies set their rules according to the type of contract and accounting standards. However, in practice: the more flexible the lease, the easier it is to see it as an operating expense. It pays to go over this with your accountant to get an accurate setup.

4) What if I exceed my mileage?

With monthly models, it is common to work with mileage packages. If you have high mileage, negotiate a suitable package or consider a longer product.

5) Is this suitable for deliveries?

Yes - vans are often the "flex" segment (season, projects, surge orders) where short-term solutions make a lot of sense.

Summary / TL;DR

- Companies keep core fleet and add flex cars for onboarding, projects and season.

- European pressure to decarbonise and market volatility increase the value of flex [4].

- Short-term leasing makes sense when the need is temporary or uncertain.

- Track KPIs: utilization, downtime, internal time, availability cost, and driver satisfaction.

- AVIS allows you to combine monthly rentals, flexible models and operating leases by horizon [1][2][3].

Keywords and entities

Main KW used: short-term leasing

Related KWs and entities: short-term car lease, monthly lease, car for a month, flexible operating lease, operating lease, fleet management, corporate fleet, SME, HR, onboarding, cash-flow, CAPEX, OPEX, TCO, residual value, electro-mobility, ESG, decarbonisation, corporate fleets, AVIS, AVIS Lease, AVIS MaxiRent, AVIS Van Rental, Business month.

Conclusion

If your business is dealing with fluctuating demand, new hires, or you want to reduce the risk of unused cars, the core + flex model is one of the most practical ways to keep mobility under control today. Choose a horizon (weeks-months-years), set KPIs, and let the fleet work for the business - not against cash flow.

Want a recommendation for your specific mix (personal + vans, mileage, season, HR onboarding)?

➡️ Ask AVIS for a no-obligation estimate and a proposal for an optimal solution.