Transition to electric vehicles in the fleet - a case study for companies

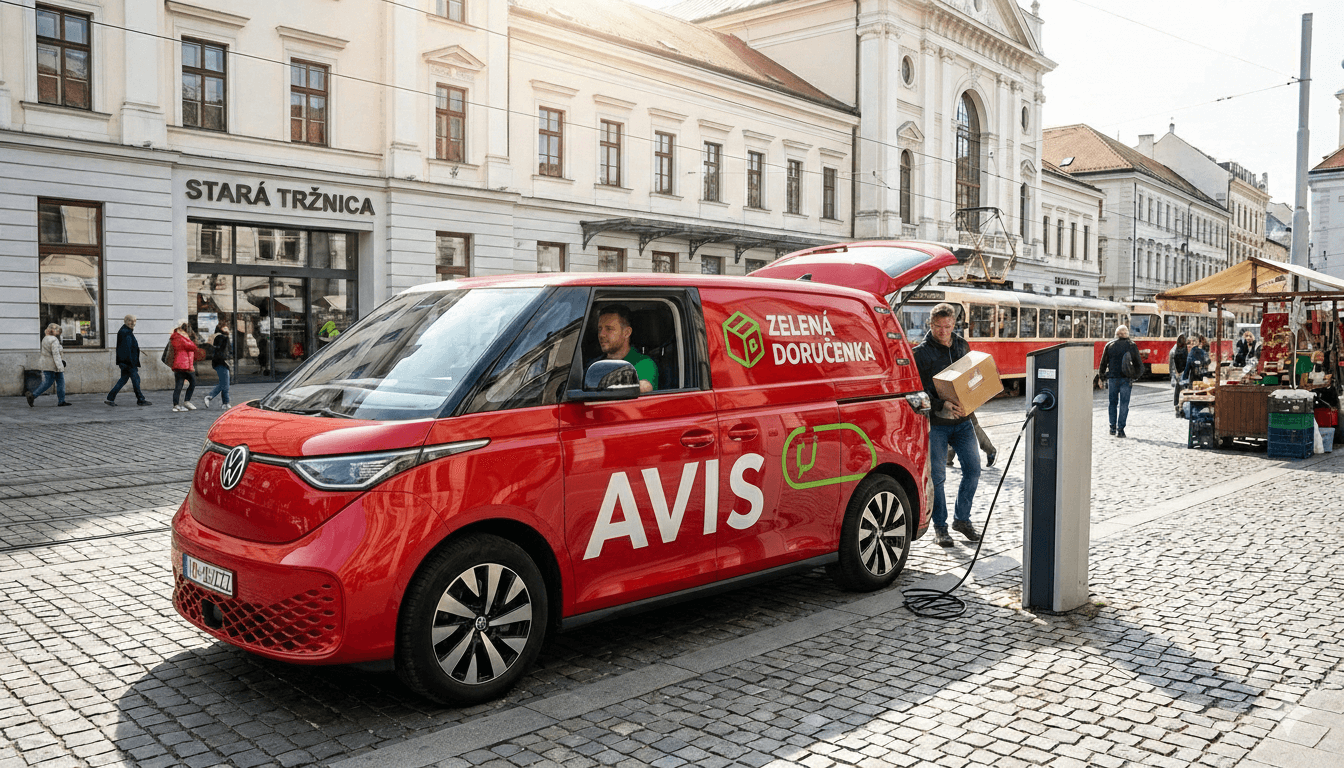

Electric vehicles are no longer an experiment for enthusiasts. In Europe, they have become a major tool for decarbonising transport, and more and more companies are figuring out how to incorporate them into their fleets sensibly, without chaos and unnecessary costs. This article offers an overview of the trends in electro-mobility, specific data from the EU and Slovakia, a model case study of a company fleet and practical guidance on how to take the first steps - using AVIS Lease, AVIS MaxiRent and AVIS Van Rental solutions.

Why companies are switching to electric vehicles

Regulatory pressure and ESG reporting

- The EU is progressively tightening CO₂ limits for cars and light commercial vehicles, with new passenger cars to be essentially emission-free after 2035.

- Corporate fleets are in the spotlight: they account for around 60% of new car registrations in Europe and generate the majority of emissions from new vehicles.

- From 2024/2025 onwards, there are legislative proposals specifically aimed at decarbonising company and leased fleets (end of tax advantages for internal combustion company cars, incentive schemes for EVs).

- ESG reporting (especially the CSRD framework) forces companies to transparently report Scope 1 and Scope 3 emissions - company cars are one of the most visible items.

Customer and employee expectations

- Customers and the public are increasingly watching to see if a company can translate its "green" slogans into real action.

- For employees, the electric car is often perceived as a modern benefit: silent driving, instant hitch, the possibility to park in green zones or preferential parking in city centres.

- Brands that drive electric vehicles are strengthening their brand as innovators - especially in the IT, e-commerce, retail and service sectors.

Cost and TCO: why an electric car is not an "expensive luxury"

When considering the cost of company vehicles, it's key to look at the Total Cost of Ownership (TCO ) - that is, not just the price of the vehicle, but also:

- fuel/electricity,

- service and maintenance,

- tyres,

- insurance,

- residual value at sale/lease termination.

Recent European studies (BEUC, IEA and others) show that:

- for corporate raids and longer ownership/leasing horizons, EVs often have the same or lower TCO than comparable petrol or diesel vehicles,

- savings come mainly from cheaper energy and lower service costs (fewer moving parts, no oil, filters or clutch),

- with a well-configured charging strategy (favourable tariffs, company chargers, night current), the overall savings compared to combustion vehicles can be 10-30%.

AVIS Lease and AVIS MaxiRent see in practice that the TCO difference is accelerating in favour of EVs wherever vehicles are driven many kilometres per year and regularly return to the same locations (headquarters, warehouse, depot).

The electromobility market in the EU and Slovakia in figures

Europe: rapid growth, but different rates by country

- In 2023, battery electric vehicles (BEVs) will account for around 15% of new passenger car registrations in the EU.

- In 2024, the market share was slightly around 13-14%, with the absolute number of BEV registrations continuing to grow - more of a 'breathing space' after a period of massive subsidies.

- In the early months of 2025, the BEV share is again around 16% of new registrations, with many governments shifting support from retail to just corporate fleets.

- European analysis of corporate fleets confirms that company cars account for around 60% of all new car registrations in the EU.

In terms of emissions:

- Life Cycle Analyses (LCA) show that an electric car in the European energy mix emits on average more than three times less CO₂ than an equivalent petrol or diesel model,

- this gap will widen further as the share of renewables in the electricity sector increases.

Slovakia: rapid growth from a low base

Slovakia is a typical "German-centric" market with a strong position for internal combustion engines, but electromobility is accelerating here as well:

- At the end of 2023, there were more than 10,000 battery electric vehicles on Slovak roads,

- by the end of 2024, the number of BEVs will have increased to around 15,500, which means a year-on-year growth of around 50%,

- in 2024, BEVs and plug-in hybrids will account for around 2.4% and 2.4% of new registrations of passenger cars and light commercial vehicles respectively.

From a European perspective, this is still a relatively small market, but corporate fleets in particular have the potential to change this ratio rapidly - especially through operating leasing, medium-term rental and gradual fleet renewal.

Corporate fleets and legislation by 2030

In 2025, the European Commission presented a package of measures to decarbonise company fleets that:

- Emphasises the need for companies and leasing companies to accelerate the transition to zero-emission vehicles,

- Phasing out tax advantages for fossil fuel company cars and creating incentives for EVs,

- emphasises the role of corporate fleets, as fleet manager decisions affect thousands of vehicles at a time.

For Slovak companies, this means that the transition to electromobility is no longer a question of "if", but "when and how " - and the sooner pilot projects start, the less of a shock mandatory regulation will bring.

Where electric vehicles make the most sense in the company fleet

Not every car in the fleet needs to be immediately replaced by an EV. A smarter strategy is to start where electromobility pays off the most economically and operationally.

Typical segments of a company fleet

- Urban logistics and delivery

- Courier services, store supply, e-commerce, food delivery, service teams,

- daily mileage of up to 150-200 km, driving in dense urban traffic (recuperation).

- Sales representatives and sales teams

- Regular routes between regions, often 25,000-40,000 km per year,

- convenient charging at company headquarters, branches or partners.

- Executive cars and pool cars

- Company image, client visits, participation in conferences,

- suitable for the modern "green car policy" benefit.

- Deliveries and LCVs in cities

- Shorter routes, clearly defined circuits,

- in the EU there is a growing supply of electric vans and city vans that can handle normal deliveries.

Quick wins in fleet electrification

- Vehicles that drive a similar route and return to the same location every day are ideal for electrification.

- Where company AC chargers can be installed (parking lot, depot), the company gains control over the cost of energy.

- For vehicles on operating leases, the transition to EVs is easier - the residual value and technology development risk is borne by the leasing company (e.g. AVIS Lease).

Case study: model Slovak company switches to electric fleet with AVIS

The following case study is a model scenario based on real data from European TCO studies and AVIS' experience with corporate fleets. It does not represent a specific client, but shows what the transition to electric mobility can look like in practice.

Baseline situation

- Company: medium-sized logistics and retail company, Slovakia

- Fleet: 100 cars and vans, mostly diesel

- Average mileage: 25 000 km per year per vehicle

- Assessment period: 4 years (standard operating lease length)

Baseline (before switching to EV):

- 100% internal combustion engine vehicles (90% diesel, 10% petrol),

- estimated average emissions of 150 g CO₂/km per vehicle,

- total annual fleet emissions:

150 g × 25 000 km × 100 vehicles = 375 tonnes CO₂ per year.

Phase 1: Fleet analysis and scenario design

The company approached AVIS to reduce emissions and stabilise TCO. The AVIS team recommended:

- Analyse real driving profiles through telematics and refuelling/accounting data,

- Identify vehicles with daily mileage up to ~200 km and regular return to HQ,

- divide the fleet into three segments:

- Segment A: urban and regional routes (ideal for BEVs),

- Segment B: mixed routes with occasional longer trips (combination of BEVs and fuel-efficient hybrids),

- Segment C: long motorway routes and foreign travel (leaving modern internal combustion vehicles at the start).

Analysis result:

- 40 vehicles in Segment A were suitable for full replacement by battery electric vehicles,

- 20 vehicles in Segment B could be replaced by a combination of BEVs and hybrids,

- 40 vehicles in Segment C remained temporarily on combustion power.

Phase 2: Pilot project (year 1)

AVIS set up a pilot for the company for 12-18 months:

- Deployment of 20 battery electric vehicles (urban hatchbacks and compact SUVs),

- using models available in the AVIS Lease and AVIS MaxiRent range,

- installation of AC chargers at headquarters and warehouse (combination of wallboxes 11-22 kW),

- driver training: efficient driving, charging planning, winter behaviour.

After one year of pilot project:

- Average energy costs per 100 km were 65-70% lower than diesel,

- service costs per EV were approximately 20-25% lower,

- drivers appreciated the silent driving and the instant hitch,

- the company got real data for the CFO and ESG team.

Phase 3: Scale-up (years 2-4)

Based on the results of the pilot, AVIS proposed next steps:

- Year 2-3: Scale up to 40 BEVs in Segment A (urban logistics, service teams),

- Year 3-4: addition of 20 more low emission vehicles (BEVs and hybrids) in Segment B,

- Gradual renewal of the rest of the fleet with more fuel-efficient models in Segment C.

Result after 4 years:

- 40 battery electric vehicles, 60 combustion vehicles (some of which are hybrids),

- projected average EV emissions: 50 g CO₂/km in the European energy mix,

- annual fleet emissions:

- 60 combustion vehicles: 150 g × 25 000 km × 60 = 225 t CO₂,

- 40 EVs: 50 g × 25 000 km × 40 = 50 t CO₂,

- total: 275 t CO₂ per year.

Emission reductions:

375 t → 275 t = -100 t CO₂ per year, i.e. approximately -27 % of fleet emissions.

Financial result (model TCO calculation)

Comparing the "business as usual" scenario (100 combustion vehicles) and the "AVIS green fleet" (40 EV + 60 combustion vehicles) for 4 years, the following results:

- Energy savings (fuel vs. electricity): approx. 18-22% in favour of the EV segment,

- savings on service and maintenance in the EV segment: 20-30 %,

- slightly higher insurance premiums for new EVs are offset by lower fuel costs,

- thanks to the AVIS Lease operating lease, the residual value risk is on the side of AVIS.

Overall model result:

- A fleet with 40% EV share was able to save around 10-15% TCO compared to a pure combustion scenario for the same number of vehicles,

- In absolute value, this is a saving of roughly €100,000-120,000 over 4 years for a fleet of 100 vehicles.

How to switch to an electric fleet with AVIS step by step

1. Audit your fleet and set goals

- Analyse your current fleet: mileage, routes, utilisation, residual values, fuel and service costs.

- Define ESG targets (e.g. 30% fleet emissions reduction by 2030) and financial targets (stabilisation or TCO reduction).

- Consult with AVIS specialists - they will help identify segments suitable for electrification.

2. Selecting suitable models and products

- Combine short-term rentals (AVIS Rent) to test individual models with mid-term rentals (AVIS MaxiRent) for flexibility and operating leases (AVIS Lease) for the core of the fleet.

- For vans and LCVs, use AVIS Van Rental, where electric and hybrid commercial vehicles suitable for urban delivery are gradually being added.

3. Charging infrastructure

- Start with a small number of AC wallboxes (11-22 kW) at headquarters and expand the network as needed.

- Set internal rules for home office charging (energy reimbursement to employees) and use of public grids.

- Consider partnerships with energy companies that can deliver comprehensive solutions (chargers, management, billing).

4. Policy on the use of company cars

- Update car policy to encourage EV use (preferential allocation, bonuses for efficient driving, incentives for charging at "cheap" times).

- Incorporate EVs into pool cars that employees reserve through an internal system - an ideal way to try them out.

5. Internal communication and education

- Explain to employees why the company is switching to EVs (ESG, cost, comfort).

- Organise test days with AVIS where they can try the electric cars for themselves.

- Prepare simple guides: how to plan charging on long journeys, what to do in winter, how to use apps.

Financial and investment insight for CFOs and business owners

CAPEX vs. OPEX: why leasing makes sense

When buying an electric car on your own, the initial investment is still higher than for a comparable internal combustion car. With operating leases and rentals, however, a company:

- exchanges high CAPEX for predictable monthly OPEX,

- transfers the risk of residual value, battery and technology price development to the leasing company,

- can continuously renew the fleet and use new models with better range and lower consumption.

Cashflow and risk spreading

- By leasing through AVIS, the company does not tie up capital in vehicles and can invest it in the core business (technology, warehouses, people).

- By combining conventional vehicles and EVs in one fleet, the company can gradually electrify without a jump in costs.

Taxes and subsidy mechanisms

- In the EU, tax advantages for zero-emission company cars are increasingly appearing (lower vehicle tax, tax advantages for non-monetary benefits, etc.).

Conversely, tax benefits for fossil fuel company cars are gradually being reduced or phased out - changing the TCO to the detriment of combustion cars.

The most common mistakes in fleet electrification

- Underestimation of infrastructure

Companies often address model selection but neglect the charging plan. The result is internal conflicts over who can charge and when. - Choosing the wrong vehicles for the wrong routes

A small city EV for long highways or a large SUV for downtown - both lead to driver frustration and skewed conclusions. - Lack of internal communication

Without explanation, training and support, drivers may feel "forced" to drive an EV and will look for reasons why it doesn't work. - Efforts to achieve 100% electrification too quickly

A more realistic and sustainable approach is gradual electrification with a pilot project, followed by scaling up and ongoing evaluation.

AVIS helps companies with its products (AVIS Lease, AVIS MaxiRent, AVIS Van Rental) by combining advice, leasing and flexibility - it is possible to change the model, change the ratio of EVs to combustion vehicles or extend the trial period if necessary.

FAQ - Frequently asked questions

1. What percentage of the fleet does it make sense to electrify first?

Typically 20-40% of the fleet, especially vehicles with regular routes and return to headquarters. After a pilot period, the proportion of EVs can be gradually increased.

2. How quickly will the investment in an electric fleet be recouped?

With the right usage and charging setup, the TCO difference to modern diesels can be evened out or tipped in favour of EVs within 3-5 years. Even sooner with heavy mileage.

3. What about long distances and foreign trips?

There is no need to electrify everything at once. Vehicles that go abroad frequently or have extreme mileage can stay in the internal combustion category until infrastructure and models improve further. EVs are ideally deployed where the infrastructure is already in place.

4. Can an EV be used as a company car for a manager?

Yes, and it is often a very attractive benefit. The company manager gets a comfortable, quiet and technologically advanced car that also reduces the company's carbon footprint.

5. Is an electric car suitable for a smaller company?

Yes. Smaller companies can start with one or two vehicles on a medium-term lease (MaxiRent) or an operating lease, where they can see first-hand what electromobility means for their specific needs.

6. What if the technology changes quickly and my EV becomes "obsolete"?

With an operating lease or rental, AVIS solves this problem - you simply switch to new models at the end of the lease. The risk of technological obsolescence is thus not borne by the company, but by the service provider.

Summary / TL;DR

- Electric vehicles in corporate fleets are increasingly competitive from a TCO perspective, mainly due to lower energy and service costs.

- Corporate fleets are at the heart of the EU - accounting for around 60% of new car registrations - and are therefore key to meeting climate targets.

- Slovakia may be starting from a low base, but the number of EVs is growing by tens of percent year-on-year and regulation is set to tighten.

- A model case study shows that switching to a 40% EV fleet can reduce emissions by around 27% and TCO by 10-15%.

- Leasing and operating leases through AVIS allow companies to test and scale EV mobility without high CAPEX and with controlled risk.

Keywords and entities

Main keywords:

- electric vehicles, corporate fleet, electromobility, green mobility, energy saving, fleet TCO, operating lease, vehicle rental, AVIS Lease, AVIS MaxiRent, AVIS Van Rental

Related entities:

AVIS, AVIS Slovakia, AVIS Lease, AVIS MaxiRent, AVIS Van Rental, Slovakia, European Union, European Commission, SEVA (Slovak Electromobility Association), ACEA (European Automobile Manufacturers Association), BEUC, IEA, Transport & Environment, EAFO (European Alternative Fuels Observatory), ESG, CSRD.

Sources and recommended reading

(selection of relevant sources to enhance credibility, including foreign)

- ACEA - Statistics on new car registrations and BEV/PHEV share in the EU (2023-2025)

- European Alternative Fuels Observatory (EAFO) - data on the share of BEVs and PHEVs in Slovakia in 2024

- Slovak Electromobility Association (SEVA) - statistics on the number of BEVs in Slovakia (2023-2024)

- BEUC - "Cost of zero-emission cars in Europe" (TCO studies for different vehicle segments)

- IEA - Global EV Outlook (EV availability and TCO trends)

- Transport & Environment - Life cycle analysis of EV emissions and corporate fleet reports

- European Commission - Documents and communications on decarbonisation of company fleets (2025)

- AVIS blogs and articles: avis.sk, avismaxirent.sk, avislease.sk (e.g. topics "electric vs. diesel", "lease vs. ownership", "green fleets")

Conclusion - getting started with AVIS

Switching to electric vehicles in your company fleet is a strategic decision that will impact costs, emissions and your brand perception for years to come. The good news is that you don't have to go it alone.

AVIS can help:

- Analyze your current fleet and develop a realistic electrification plan,

- test specific EV models on short or medium-term lease,

- set up an operating lease to combine electric and combustion vehicles according to your real needs,

- continuously evaluate TCO, emissions and driver satisfaction.

Want to know how much your company would realistically save by switching to an electric fleet?

Contact the AVIS Slovakia team via avis.sk / avislease.sk / avismaxirent.sk to arrange a no-obligation consultation on your fleet.